How will you know how to choose the right real estate appraiser in Israel?

How do you know if the appraiser you choose will be professional enough and will thoroughly know the city where your real estate is located?

There are many real estate appraisers in Israel. choosing a real estate appraiser in Israel should be done very carefully.

The license to engage in real estate appraisal is issued by the Israeli Ministry of Justice.

As you know, Israel is a small state. however, its land values vary drastically depending on its geographical location.

For example, real estate located in the eastern part of Israel will usually be worth less than real estate located near the coastline (west).

Despite the same certification given to the real estate appraiser in Israel, there is a significant difference between the appraisers.

There are real estate appraisers in Israel who are less involved in complex areas such as real estate taxation, expropriations, impairment claims, building rights, lawsuits in the courts, the "Israel Land Authority taxation" and more.

On the other hand, there are real estate appraisers who specialize in many complex areas, with an emphasis on real estate taxation.

Real estate taxation in Israel is complex and in many cases extended by several entities.

The purpose of this article is to help foreign residents choose a professional real estate appraiser in Israel and not fall for an appraiser who does not know how to provide the work as required.

Choosing a real estate appraiser in Israel who has in-depth knowledge in many areas will ensure that the work is carried out with great precision and thoroughness.

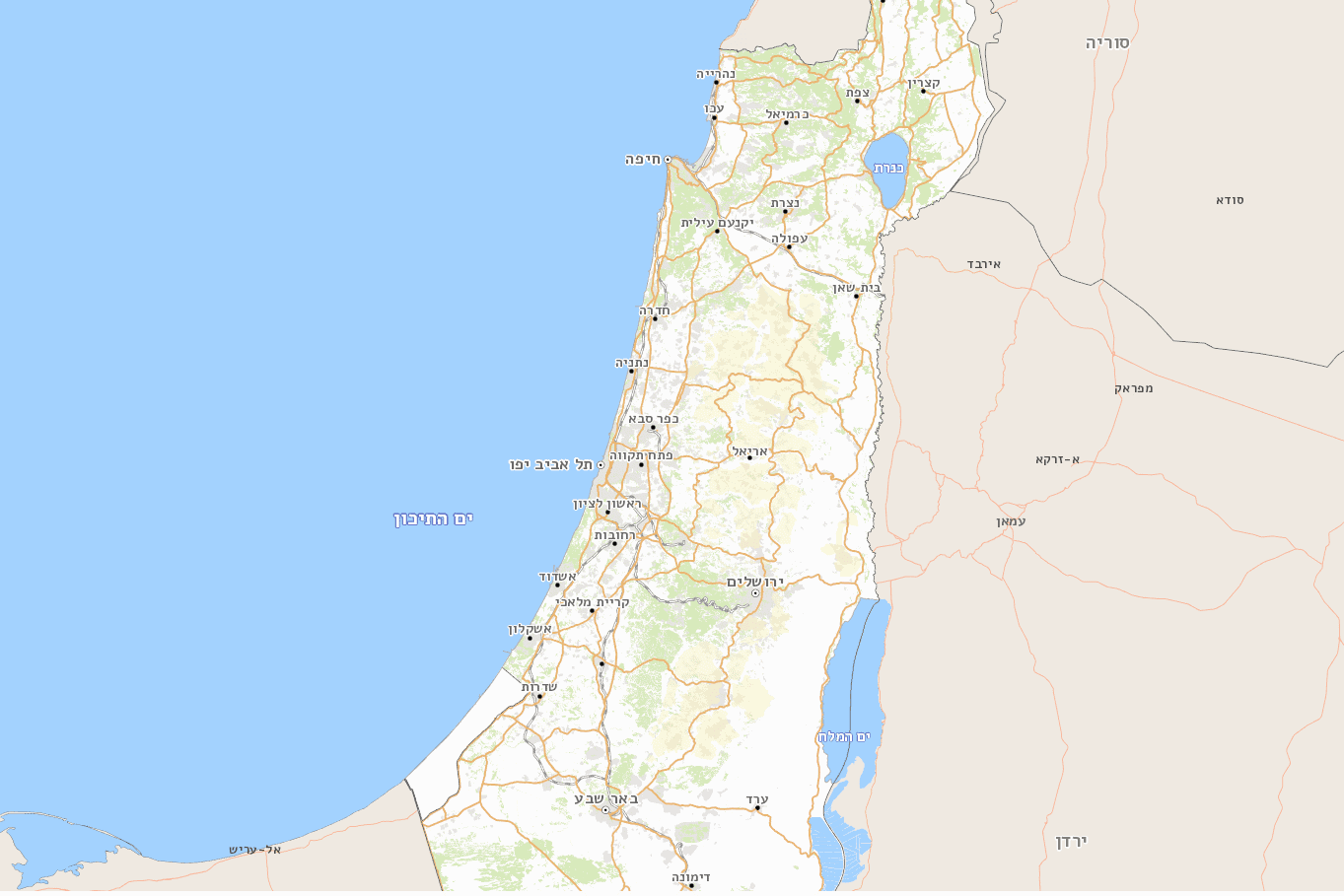

In this article, we will divide the state of Israel into three areas: North, Central, and South.

Map of the division of Israel by regions:

Table of contents [Close]

- What should a real estate appraiser know about the taxes paid by the sellers:

- Example of Improvement/betterment levy tax on an additional floor:

- Example of Improvement/betterment levy tax on a basement addition:

- What should a real estate appraiser in Israel know about linear appreciation tax?

- Taxation to the Israel Land Authority:

- What should a real estate appraiser know about the taxes paid by buyers:

What should a real estate appraiser know about Tel Aviv and the center of the state?

The center of the state coordinates most of Israel's economic activity.

As known, the offices of the largest companies (APPLE, IBM, GOOGLE, and MICROSOFT) are mostly located in the center of the state.

The central area includes the following cities: Tel Aviv, Rishon Lezion, Holon, Bat Yam, Petah Tikva, Ramat Hasharon, Hod Hasharon, Herzliya, Kfar Saba, Raanana, Givatayim, Netanya, and more.

In general, land values in the center of the state are among the most expensive.

Tel Aviv is considered the capital of the Israeli economy.

For instance, in Tel Aviv near the coastline, land prices vary by about 8,000 $ per square meter built from street to street.

A real estate appraiser in Israel in Tel Aviv is required to be familiar with the conservation plan (preservation of buildings of historical importance) and the new transportation system planned in the city (light rail and metro).

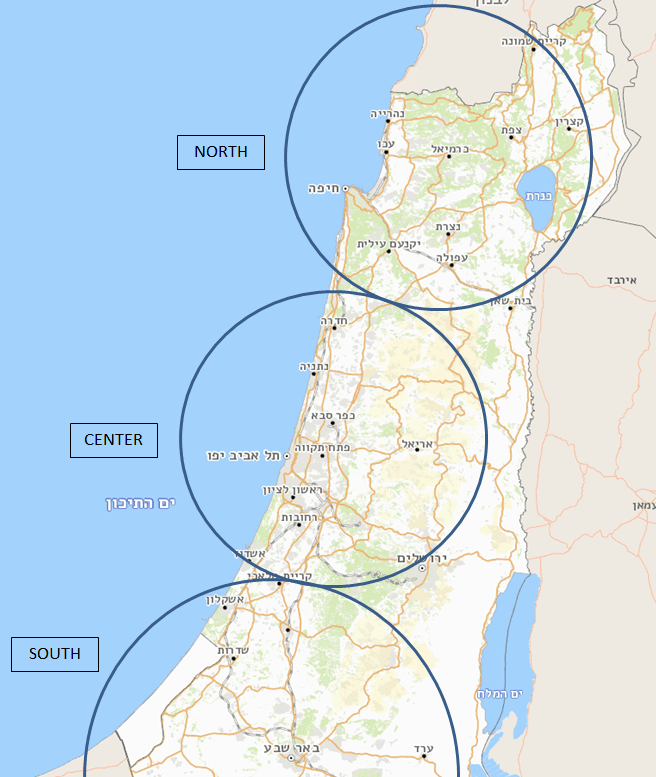

What a real estate appraiser in Israel needs to know about the Tel Aviv conservation plan:

The conservation plan restricts the use of building rights and sets limits aimed at preserving the historic building.

Purchasing a building for conservation to take advantage of the building rights that apply to the house by urban planning should be done with great care.

However, a real estate appraiser in Israel who is well versed in the conservation plan documents can enlighten buyer's eyes on the various restrictions set by the conservation plan.

Map of the conservation plan:

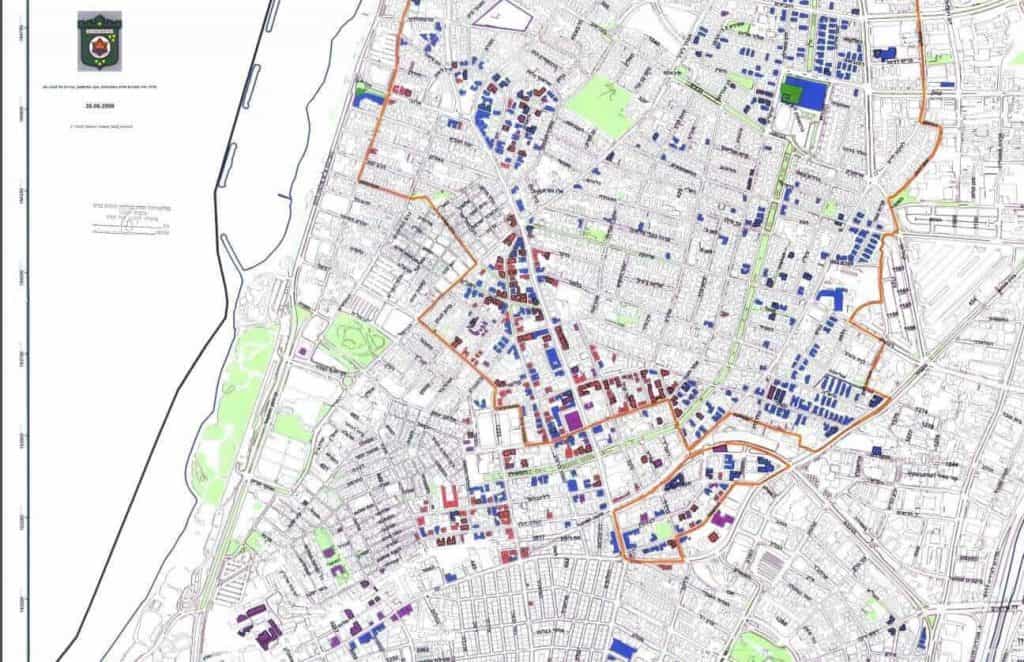

What a real estate appraiser in Tel Aviv needs to know about the new transportation plan for the city:

The light train is a transportation network consisting of several train lines that will cover the central area and the "Gush Dan" area.

As is well known, residential real estate that has higher accessibility to transport routes, its price is higher than real estate far from the light rail and metro lines.

The transportation network will include several lines.

The red line: will connect Tel Aviv with Givatayim, Bat Yam, Bnei Brak, Petah Tikva, and more.

Red line map:

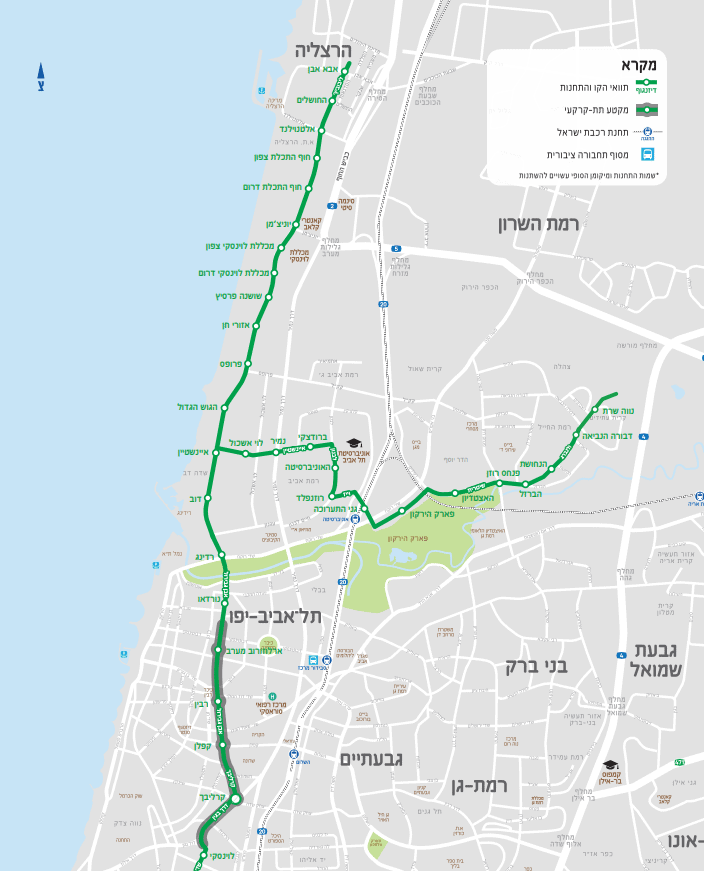

The Green Line: will connect Tel Aviv Rishon Lezion, Holon, Bat Yam, Ramat Hasharon, Herzliya, and more.

Green Line Map:

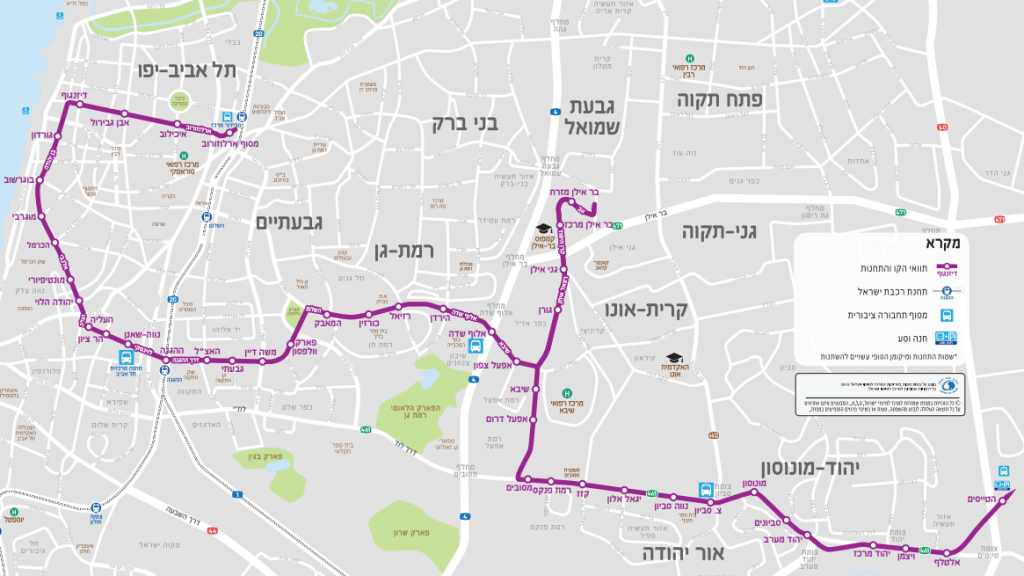

The purple line: will connect Tel Aviv with Ramat Gan, Givat Shmuel, Kiryat Ono, Or Yehuda, Yehud and more.

Purple line map:

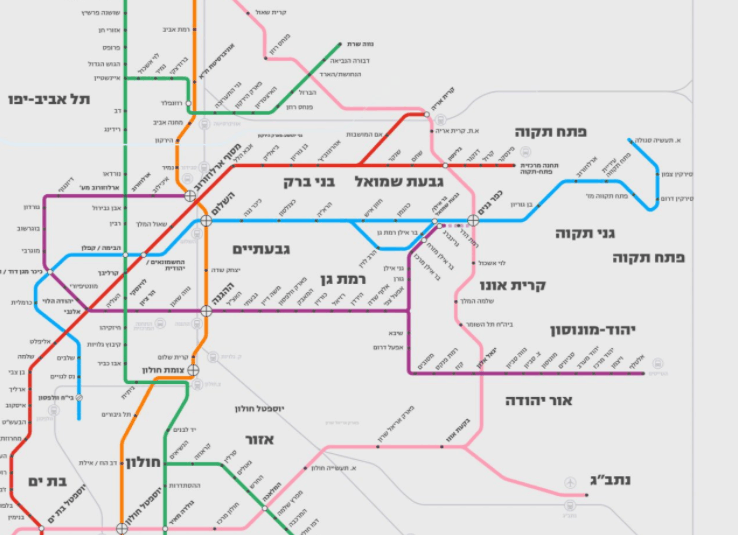

In addition to the planning of the light rail, part of which will be underground and partly will pass above the ground, there is planning for the underground metro lines that will be integrated into the light rail system.

Part of the map of the metro lines:

What should an appraiser know about Haifa and the north of the state?

The city of Haifa constitutes the metropolis of the north of the state.

Above all, the northern district includes the following cities:

Hadera, Pardes Hanna, Or Akiva, Haifa, Afula, Acre, Tiberias, Carmiel, Kiryat Ata, Kiryat Yam, Kiryat Bialik, Nahariya, and more.

In general, land values in areas near Haifa and the coast are higher than real estate in eastern Israel.

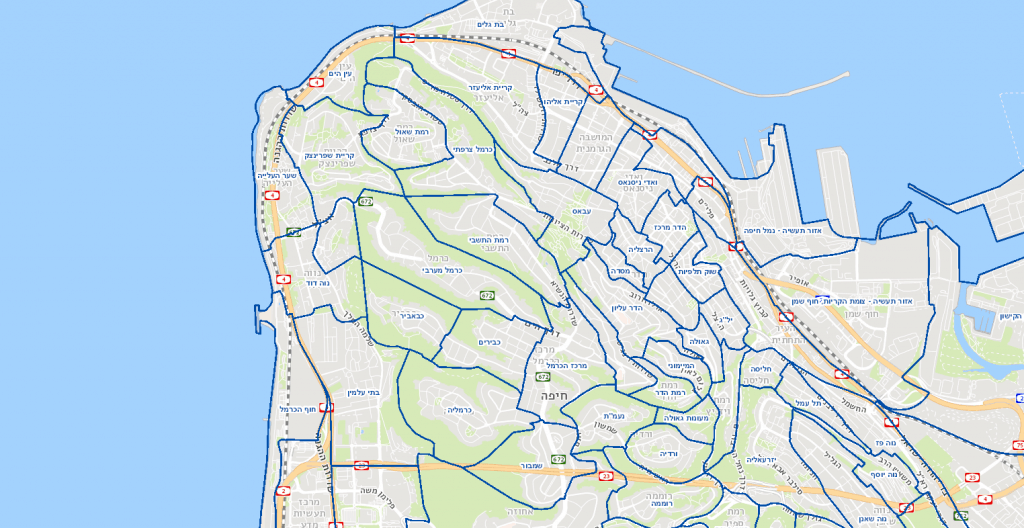

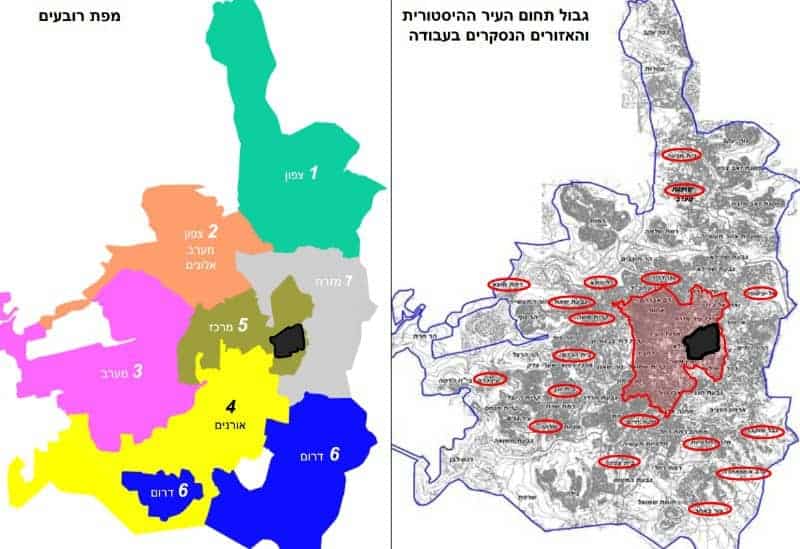

In Haifa, many neighborhoods differ from each other in landscape values, building density, and land prices.

The price of an apartment in the Carmel neighborhood will be significantly higher than a similar apartment in the Hadar neighborhood.

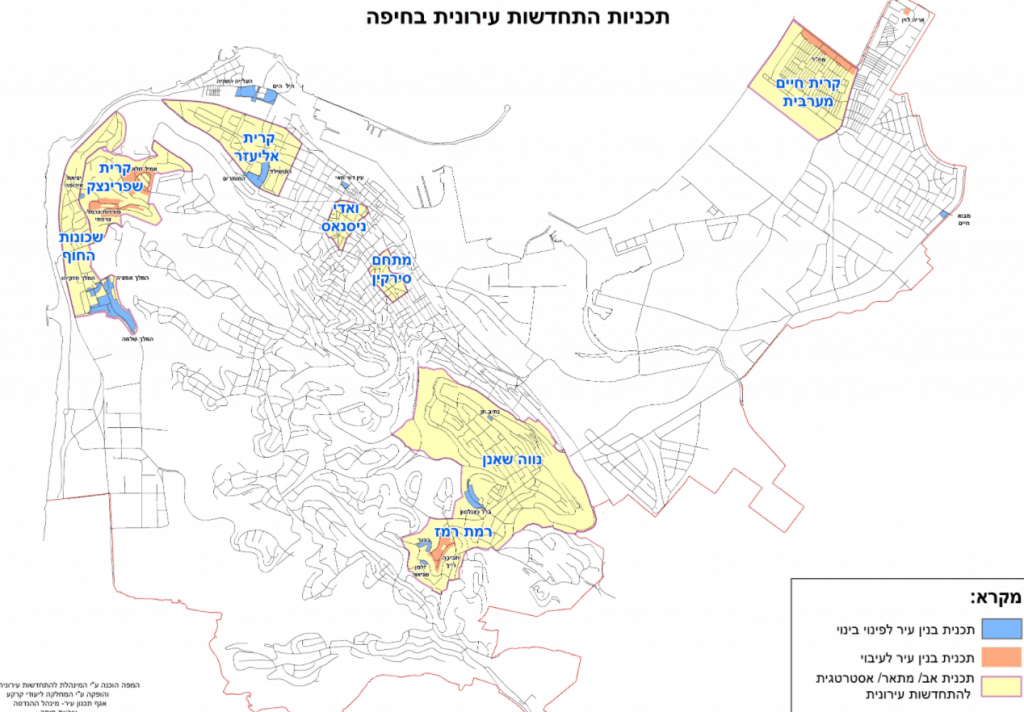

Map of the neighborhoods of Haifa:

A real estate appraiser in Haifa is required to constantly monitor the urban renewal plans.

In Haifa, there are many projects of demolishing new buildings and building new modern buildings using the "evacuation construction" method.

"Evacuation of construction": The contractor demolishes a residential building (at least 24 units) and builds a modern high-rise building in its place.

The contractor houses the evicted tenants at the expense of other apartments and finances the monthly rent, including moving expenses.

When the new building is ready, the contractor moves the tenants from the rented apartments to new apartments.

In practice, the tenant hands over an old and not modern apartment and receives in return a larger and more modern apartment.

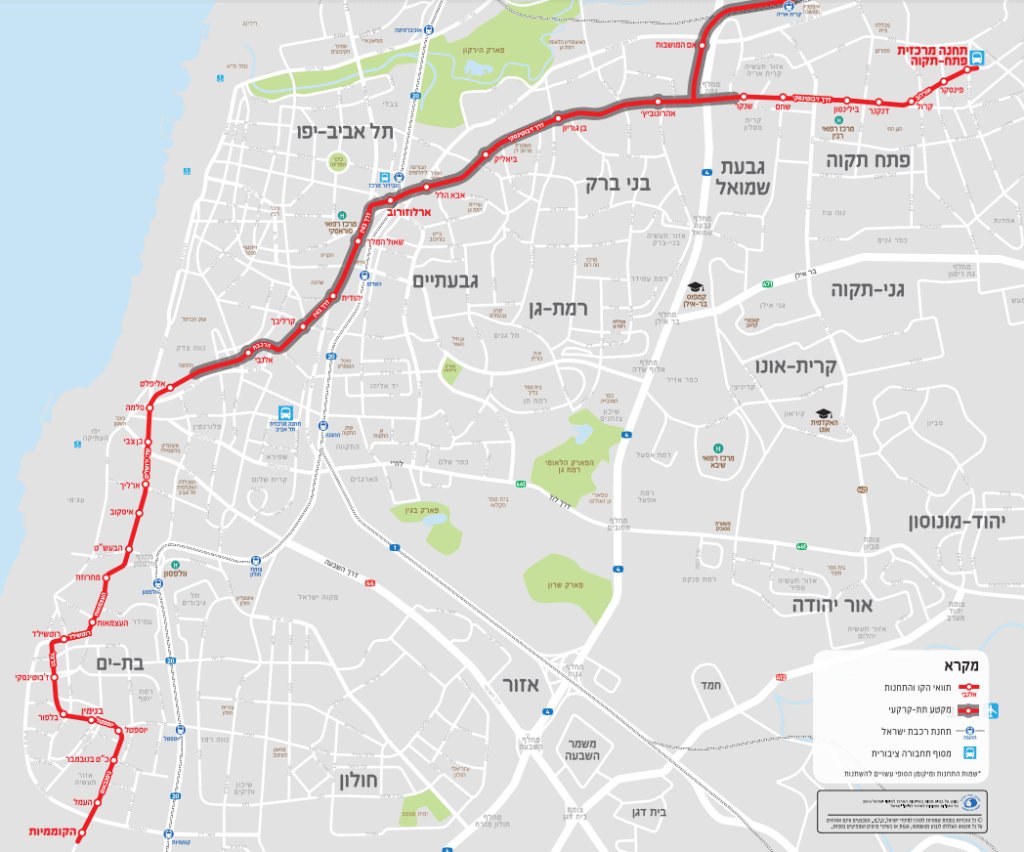

The following is a map of the complexes defined for urban renewal plans:

What should an appraiser in Israel know about Jerusalem?

The city of Jerusalem consists of many neighborhoods. Each neighborhood has its characteristics.

There are neighborhoods of a religious nature, neighborhoods of a secular nature, industrial areas, religious complexes, government, state complexes, and more.

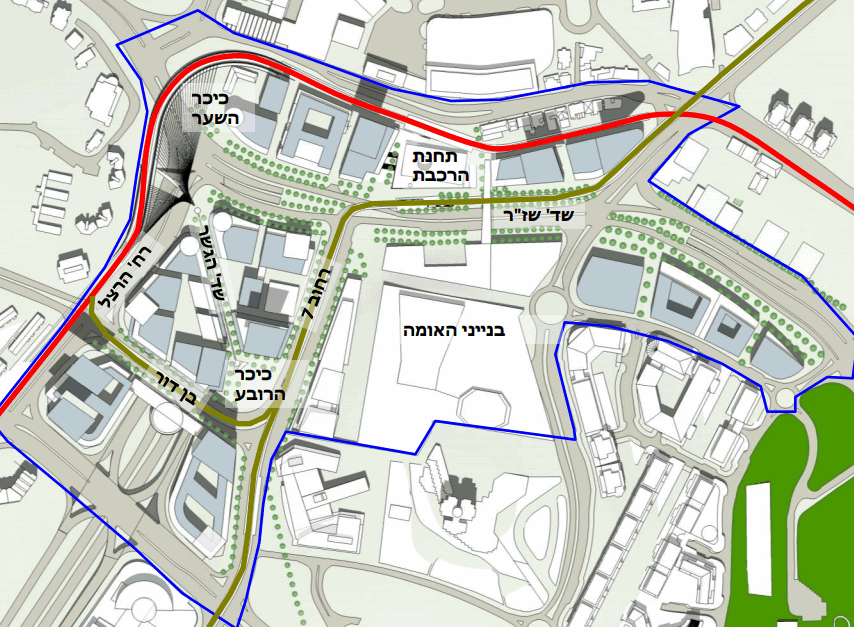

A real estate appraiser in Jerusalem needs to be familiar with the "master" plans for the city. Recently, the Jerusalem Municipality published master plans for the neighborhoods.

The plan defines building rights, complexes for urban renewal, industrial areas (Talpiot neighborhood), and more.

Below is a diagram of the proposed planning for entering the city:

Like Tel Aviv, Jerusalem also has a conservation program.

A real estate appraiser in Israel needs to know Jerusalem's conservation plan to make an accurate real estate appraisal.

The plan divides Jerusalem into seven districts and defines the goals and principles of conservation in them.

The following is a diagram of the Jerusalem conservation plan:

There are four main components of real estate taxation in Israel. The tax is often paid by both buyers and sellers.

What should a real estate appraiser know about the taxes paid by the sellers:

A seller of a real estate property in Israel is exposed to three main tax components.

As usual, the tax is usually paid on the increase in the value of the land from the date of its acquisition.

New building rights taxation (Improvement/betterment levy):

the tax paid to the municipal authority (not to the state treasury) and the payment is for building rights that were added while the land was owned by the seller.

Example:

In 2015, the seller purchased a private house built size of 200 square meters. Today, in 2021, the seller wants to sell the house at a maximum price.

In 2017, a city building plan was approved which allowed the construction of an additional floor measuring 100 square meters.

When the seller offers the house for sale, he will indicate in the advertisement that the house has 200 sqm. Built and 100 sqm of Building rights for an additional floor.

According to the Planning and Building Act, the Improvement/betterment levy (required on additional building options) is 50%.

Thus, to complete the legal registration, the Improvement/betterment levy tax must be paid.

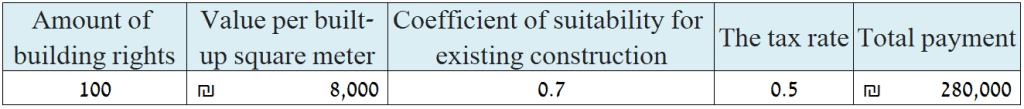

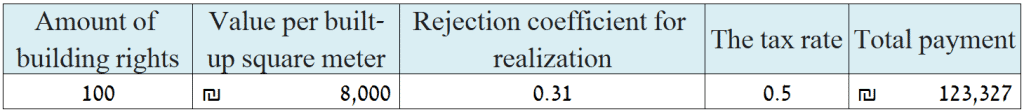

Example of Improvement/betterment levy tax on an additional floor:

A professional real estate appraiser knows how to prove that the construction costs of an additional floor in a populated house are much higher than the construction cost of the floor in a house that is under construction.

In this example, a real estate appraiser in Israel saved the seller 30% of the tax payable:

Example of Improvement/betterment levy tax on a basement addition:

In Israel, it is customary to calculate the economic contribution of a house in the range of 50-60 years.

The following example shows how a real estate appraiser in Israel can save you over 70% of building rights taxation.

In this example, it is a 30-year-old house.

The house is in good condition. Recently, a plan was approved that allows the construction of a basement floor with a size of 100 square meters.

By common sense, today, there is no economic viability to demolish the house to construct a basement.

Accordingly, a professional real estate appraiser in Israel will know how to perform a deferral calculation of the economic contribution of the basement building rights.

What a real estate in Israel needs to know about land Appreciation Tax:

Land appreciation tax (LAT) is paid to the state treasury for the natural increase in the value of the real estate properties. The LAT tax is paid on the difference between the purchase price and the sale price.

The Land appreciation tax (LAT) distinguishes between commercial real estate and real estate for residential use (residential apartments, private homes, and more).

In conclusion, a real estate appraiser in Israel who is familiar with the real estate taxation Law can save you a lot of money through various exemptions granted by the law.

Among the common exemptions in residential real estate:

Full exemption on selling a single apartment (ceiling top of 5,008,000 NIS).

Exemption in respect of consideration affected by additional building rights, section 49.

Full praise tax exemption and linear taxation.

What should a real estate appraiser in Israel know about linear appreciation tax?

A seller who is not entitled to a full exemption because he owns more than one apartment may be entitled to linear taxation.

Israel was exempted from paying elevation tax on all residential real estate untill 2014.

As of 2014, a tax of 25% is paid for the increase in the value of the real estate.

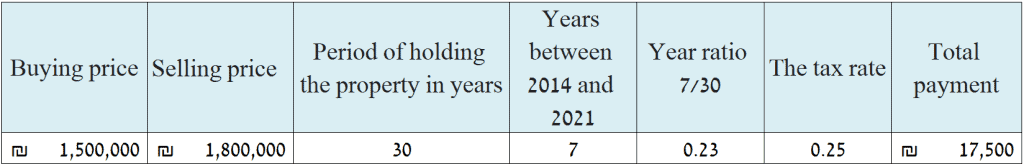

Example:

Let's assume that the house has been owned by the seller for 30 years.

The seller is selling the house in 2021.

Purchase price 1,500,000 NIS. The selling price is 1,800,000 NIS.

The seller has an additional apartment (not entitled to a full exemption for a single apartment).

The calculation is performed as follows:

Taxation to the Israel Land Authority:

In Israel, many real estate properties are leased by the state to tenants for a long period (about 100 years).

The real estate is leased for a specific purpose (residential or business) and the lease contract defines a certain construction capacity.

If a lessee seeks to sell the real estate leased to him, he will be required to pay the state a "capitalization" fee.

The payment usually consists of the difference in building rights as leased in the original contract and the potential of the real estate derived from municipal planning.

Land authority tax usually applies to plots larger than 280 square meters for residential use.

What should a real estate appraiser know about the taxes paid by buyers:

A foreign resident who is interested in purchasing real estate in Israel must pay a "purchase tax". The tax is a certain percentage of the value of the real estate.

The tax paid by a foreign resident is 8% of the value of the real estate up to a ceiling of approximately 5,000,000 NIS

Above this ceiling, a purchase tax of 10% of the value of the real estate will be paid.

A link to the government Ministry of Justice website.

In our office, A.Paz Real Estate, qualified real estate appraisers with decades of experience proficient in a variety of real estate appraisal areas.

Our office has extensive knowledge of the areas of real estate taxation.

Phone: *2698, +972-504-837-837

Website: https://shamay-mekarkein.com/

The information is general only and is not legal and may change. Before buying or selling real estate, consult a qualified person. ט.ל.ח. בכפוף לתקנון.

- מה צריך לדעת לפני שבוחרים שמאי מקרקעין באשדוד? - 29/03/2025

- מה צריך לדעת לפני שבוחרים שמאי דירות בראשון לציון? - 22/03/2025

- Оценщик недвижимости в Ашдоде – какова его роль - 21/03/2025